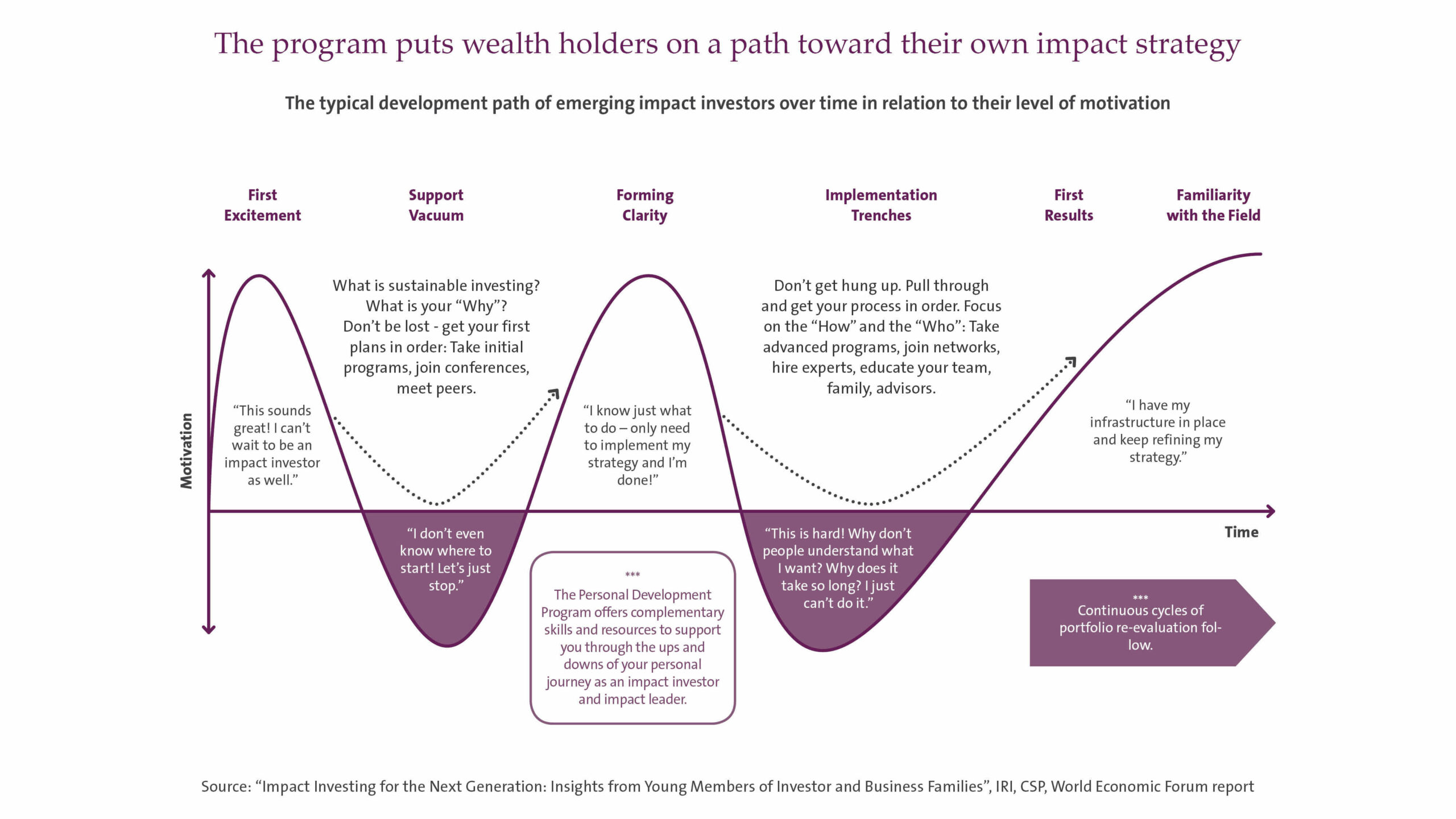

The Program

Participants during the 2021 - 2022 training

Dates for the 11th Cohort

Initiated in 2015 at the Initiative for Responsible Investment at the Harvard Kennedy School, the 11th iteration of the Impact Investing for the Next Generation Program is scheduled as follows:

Module 1: October 28th-31st, 2025 in Boston

MIT Sloan School of Management

Massachusetts Institute of Technology (MIT),

Cambridge, Massachusetts, USA

Module 2: April 28th-30th, 2026 in Zurich

Center for Sustainable Finance & Private Wealth (CSP), Zurich, Switzerland

Each cohort provides a protected environment for max. 30 participants, principals-only, opening up to a community of 250+ alumni.

Curriculum 2025-2026

Registration, Info & Fees

Download the brochure for more information

- Applications are reviewed on a rolling basis following individual interviews.

- Price: CHF 23,100 per participant (fee subject to change).

- Program fee includes: onboarding and online training sessions, incl. meals and drinks, support by CSP staff pre, during and post-program, coursework resources, access to alumni community and resources post-program completion; excludes transportation and accommodation costs for the in-person training sessions.

- Registration deadline: August 15th, 2025.

Program Founders & Team

Dr. Falko Paetzold

Program Co-Founder, Founder CSP, Managing Director CCSP-HSG

Dr. James Gifford

Program Co-Founder & Founder of the UN Principles for Responsible Investment

Temple Fennell

Program Co-Founder & Family Member of Keller Enterprises – Single Family Office

Dr. David Wood

Program Co-Founder & Senior Research Associate at the Social Innovation and Change Initiative at the Harvard Kennedy School

Dr. James Gifford

Program Co-Founder & Founder of the UN Principles for Responsible Investing

Temple Fennell

Program Co-Founder & Family Member of Keller Enterprises – Single Family Office

Dr. David Wood

Program Co-Founder & Director of the Initiative for Responsible Investment at Harvard Kennedy School

Dr. Jason Jay

Senior Lecturer at the MIT Sloan School of Management and Director of the Sustainability Initiative at MIT Sloan

Marietta Chatzinota

Next Gen Program Lead at the Center for Sustainable Finance and Private Wealth at the University of Zurich

Shannon Wolff

Event Manager at the Center for Sustainable Finance and Private Wealth at the University of Zurich